An Unbiased View of Paul B Insurance Medicare Advantage Plans Huntington

Table of ContentsRumored Buzz on Paul B Insurance Medicare Advantage Agent HuntingtonThe smart Trick of Paul B Insurance Medicare Supplement Agent Huntington That Nobody is Talking AboutRumored Buzz on Paul B Insurance Medicare Agent HuntingtonPaul B Insurance Medicare Advantage Plans Huntington Can Be Fun For EveryoneThe Buzz on Paul B Insurance Medicare Health Advantage HuntingtonPaul B Insurance Medicare Health Advantage Huntington Can Be Fun For Anyone

People with end-stage renal disease ended up being eligible to register in any kind of neighborhood Medicare Benefit strategy in 2021. Individuals with end-stage renal illness (ESRD) became qualified to register for any type of Medicare Advantage plan in their area in 2021. ESRD clients ought to contrast the expenses as well as advantages of Medical Benefit intends with those of typical Medicare insurance coverage, as well as ensure their physicians and also healthcare facility remain in the strategy's provider network.

They commonly provide lower premium prices and also cover more services than traditional Medicare, while limiting treatment to in-network companies and calling for references for consultations with experts. Medicare Advantage can end up being costly if you're ill, as a result of co-pays. The registration period is limited, and also you won't be qualified for Medigap coverage if you have Medicare Advantage.

Unknown Facts About Paul B Insurance Local Medicare Agent Huntington

Yes. Medicare Advantage uses insurance coverage for people with preexisting conditions.

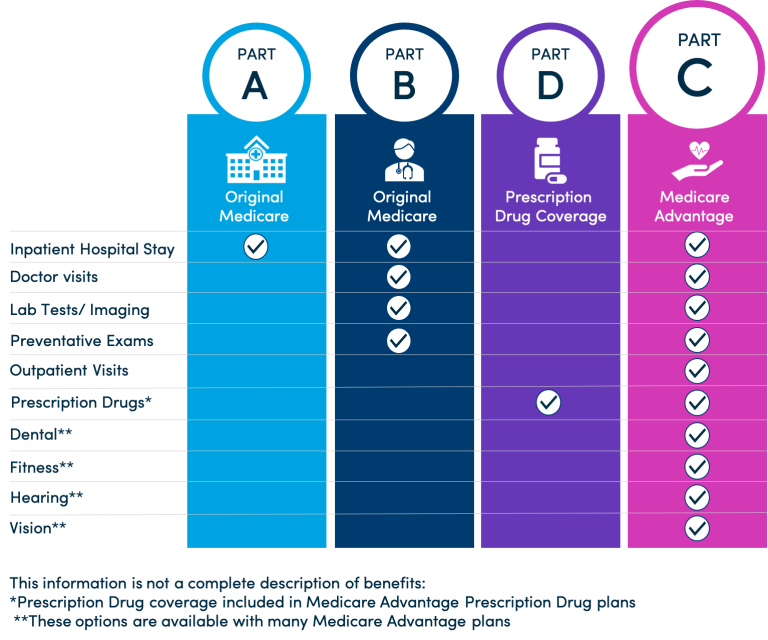

Consider a Medicare Benefit strategy as thorough insurance coverage for your healthcare requires. A few of the advantages most Medicare Benefit strategies have that Initial Medicare does not have consist of: Medicare Advantage prescription drug (MAPD) plans are Part C prepares integrated with Part D prescription drug plans. While Medicare Part D gives just prescription medicine coverage, Medicare Benefit strategies can be incorporated to cover that and also more.

You get all Medicare-covered benefits via the personal MA plan you select. Some MA plans deal Medicare prescription drug coverage (these are called MA-PD strategies), yet various other plans do not (these are called MA-only plans). If you sign up with an MA-only strategy, you might or may not join a separate Medicare Component D plan relying on the sort of MA prepare you join.

Indicators on Paul B Insurance Medicare Supplement Agent Huntington You Need To Know

If hospice coverage is not used via your MA plan, you can access it independently through Original Medicare., we have actually assembled information on the 3 kinds of Medicare Benefit intends: Some employer-sponsored and also senior citizen plans use wellness coverage through MA plans. See Medicare & Other Health And Wellness Insurance coverage for more details.

More than likely, neither your HMO strategy nor Medicare will cover the expense. Some HMOs supply a Point-of-Service (POS) option that permits you to see doctors outside the plan's network, often for an navigate here extra expense. HMOs that offer this option may additionally limit when you can utilize it. Some HMOs offer Medicare Part D prescription drug protection as well as others do not.

See Prescription Medications for more details. HMOs are the most popular kind of MA plan in The golden state, yet they are not readily available in every component of the state. In 2023, 52 areas have at least one HMO plan. my site As well as 6 regions have no HMO. The regions with no HMO include: Alpine, Calaveras, Colusa, Lassen, Sierra and also Trinity.

Paul B Insurance Medicare Supplement Agent Huntington Fundamentals Explained

Medicare PPOs like Medicare HMOs have networks of service providers. If you see suppliers outside the network, the strategy still covers you but you pay greater cost-sharing than if you see network providers.

Understood as Medicare Part C, Medicare Advantage strategies are supplied by exclusive insurance companies that have actually been approved by Medicare.

Personal fee-for-service, or PFFS, strategies: Permit you to see any kind of Medicare-approved healthcare supplier as long as they accept the strategy's settlement terms and also agree to see you. You may likewise have access to a network of suppliers. You can see medical professionals that do not approve the plan's repayment terms, however you could pay even more.

The 8-Second Trick For Paul B Insurance Insurance Agent For Medicare Huntington

The plans you can pick from will depend upon your ZIP code and region. While you may not have a lot of Medicare Benefit options if you stay in a backwoods, metropolitan dwellers might have two dozen or more choices available. Narrow the area with these techniques: Locate the star ranking.

"It's based on efficiency on a variety of various points to do with top quality, including things like, 'How receptive is the strategy to any kind of problems or inquiries?'" claims Anne Tumlinson, CEO of healthcare study as travel insurance international well as consulting company ATI Advisory. The star rating goes from 1 to 5 celebrities, with 5 stars being superb.

The two primary expense factors to consider are a plan's premium and also the optimum out-of-pocket expense, which is one of the most you'll pay in a year for protected healthcare. The plan optimum can be as high as $8,300 out of pocket in 2023, where plans with lower out-of-pocket maximums have higher costs.

Paul B Insurance Local Medicare Agent Huntington Things To Know Before You Get This

Before you pull the trigger on a plan, go to the company's internet site and make sure you understand all the benefits as well as constraints. "What we're seeing is that strategies are supplying these new and various advantages, like at home palliative care," Tumlinson says. Those are exciting and also, if you have a demand, they're something to take into consideration.

If you have any kind of questions about the procedure, you can get to the folks at Medicare at 800-MEDICARE (800-633-4227), or you can locate details at Medicare. gov. Compare top strategies from Aetna, Chapter is an accredited Medicare broker, partnered with Nerdwallet. Compare inexpensive Medicare strategies from Aetna with Chapter, free of cost, Learn more regarding the various parts of Medicare as well as what they cover.